Getting My Pvm Accounting To Work

Table of ContentsPvm Accounting Can Be Fun For EveryoneThe Ultimate Guide To Pvm AccountingThe Best Guide To Pvm AccountingThe Facts About Pvm Accounting RevealedMore About Pvm Accounting6 Easy Facts About Pvm Accounting Explained

Supervise and take care of the development and authorization of all project-related payments to consumers to promote excellent communication and stay clear of issues. financial reports. Guarantee that proper records and documentation are submitted to and are updated with the internal revenue service. Make sure that the bookkeeping process adheres to the regulation. Apply required construction accountancy criteria and treatments to the recording and reporting of building and construction activity.Connect with different financing companies (i.e. Title Company, Escrow Company) regarding the pay application procedure and needs required for payment. Assist with implementing and maintaining inner economic controls and treatments.

The above declarations are meant to explain the basic nature and degree of job being done by people assigned to this classification. They are not to be understood as an exhaustive checklist of duties, duties, and skills called for. Workers may be required to do responsibilities outside of their regular obligations once in a while, as required.

Pvm Accounting Can Be Fun For Anyone

Accel is looking for a Construction Accountant for the Chicago Office. The Building Accounting professional performs a variety of accountancy, insurance policy compliance, and job management.

Principal obligations consist of, yet are not limited to, managing all accounting features of the business in a prompt and exact fashion and providing reports and routines to the business's certified public accountant Firm in the preparation of all financial statements. Guarantees that all accountancy treatments and features are taken care of properly. Liable for all economic records, payroll, banking and daily procedure of the bookkeeping function.

Prepares bi-weekly trial balance records. Functions with Job Managers to prepare and post all monthly billings. Procedures and issues all accounts payable and subcontractor payments. Creates month-to-month wrap-ups for Workers Settlement and General Obligation insurance policy costs. Generates month-to-month Task Cost to Date records and dealing with PMs to integrate with Job Managers' budgets for each project.

Pvm Accounting - The Facts

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Workplace) and Procore construction administration software program an and also. https://www.huntingnet.com/forum/members/pvmaccount1ng.html. Must likewise be proficient in various other computer software application systems for the prep work of reports, spreadsheets and other accounting analysis that may be called for by management. Clean-up accounting. Should possess solid business abilities and ability to prioritize

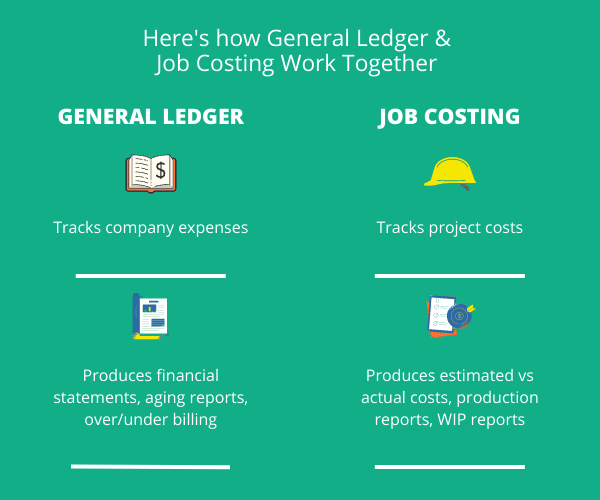

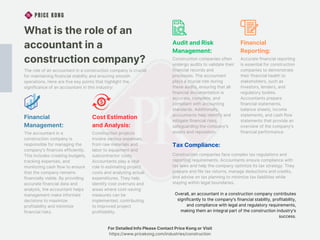

They are the monetary custodians that make certain that construction jobs remain on budget, follow tax policies, and preserve economic openness. Building and construction accounting professionals are not just number crunchers; they are critical partners in the building process. Their main role is to handle the monetary elements of building jobs, making sure that sources are alloted successfully and economic threats are minimized.

The Best Guide To Pvm Accounting

They function very closely with job managers to create and monitor budgets, track expenditures, and projection monetary needs. By keeping a tight hold on job finances, accounting professionals assist prevent overspending and financial setbacks. Budgeting is a keystone of successful construction tasks, and building accounting professionals are important original site in this regard. They develop comprehensive spending plans that incorporate all job expenses, from products and labor to permits and insurance policy.

Building and construction accountants are skilled in these guidelines and make certain that the job complies with all tax demands. To stand out in the duty of a building accounting professional, people require a solid educational foundation in accountancy and money.

In addition, accreditations such as Qualified Public Accounting Professional (CPA) or Certified Building And Construction Market Financial Professional (CCIFP) are highly pertained to in the market. Construction tasks frequently involve limited deadlines, transforming guidelines, and unforeseen expenses.

The Only Guide to Pvm Accounting

Specialist qualifications like certified public accountant or CCIFP are also very advised to demonstrate competence in building audit. Ans: Building accountants develop and keep an eye on budget plans, identifying cost-saving chances and making sure that the project remains within budget plan. They additionally track costs and forecast economic requirements to avoid overspending. Ans: Yes, building and construction accountants manage tax obligation compliance for building and construction jobs.

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction business need to make challenging selections among lots of monetary alternatives, like bidding on one task over another, choosing funding for materials or tools, or setting a job's earnings margin. Building is an infamously unpredictable industry with a high failing rate, sluggish time to settlement, and irregular cash flow.

Manufacturing involves duplicated procedures with quickly recognizable costs. Manufacturing requires different procedures, products, and equipment with varying expenses. Each project takes location in a brand-new area with varying site conditions and distinct obstacles.

8 Simple Techniques For Pvm Accounting

Resilient connections with suppliers reduce arrangements and boost effectiveness. Irregular. Constant usage of various specialized service providers and distributors influences effectiveness and money flow. No retainage. Repayment shows up in full or with regular settlements for the complete contract amount. Retainage. Some portion of payment might be held back up until job conclusion also when the contractor's work is finished.

While traditional makers have the advantage of controlled atmospheres and optimized production procedures, construction business must regularly adjust to each new job. Also somewhat repeatable jobs call for modifications due to site problems and other elements.

Comments on “The Only Guide for Pvm Accounting”